A few years ago Mr. Sexy and were writing bad checks for over $1,000. Even now, I struggle not to blame him for our awful financial situation. So it’s true, that forgiveness happens daily and the more I practice, the easier it becomes. Today, the myth that Mr. Sexy was to blame for our financial mess is a far-off thought – one I must remember I had in order to share how far we have come.

In truth, it was his fault. It was my fault. It was OUR fault. We were handling our money ass-backwards. I had a bad day, so I wanted some retail therapy. It made me feel better. Then a few days later when we couldn’t pay the credit card, I felt sick to my stomach, not to mention angry. However I wasn’t angry at myself. I wasn’t in control of what I purchased by any means! I always “asked” Mr. Sexy with my I-know-you-will-do-anything-for-me eyes and he always sighed and said, “I’ll make it work.” Therefore, none of the responsibility laid on my shoulders. I was a princess. I always got what I wanted, when I wanted.

Over time I learned not to even go into the mall. Even though the entire store was 60% off and the sale would never happen again (which it always will), I could not tempt myself to entertain even the advertisements. I became so used to avoiding shopping as an extracurricular that I don’t know how to do it anymore. Shopping for “fun” is overwhelming to me. The choices are so many! The prices seem way to high – even the sale prices. Over our recent Spring Break I did some fun shopping with my sister-in-laws and I couldn’t believe how fast I spent $200! The beauty of it was that we could afford it. We saved for it. Plus I have amazing Buyer’s Remorse and returned half the items the next day. But it felt wonderful to know that we had saved some money for our big trip and that I could go out and actually buy myself new clothes – something I haven’t done in ages.

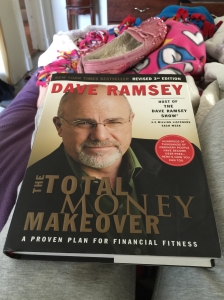

Now we are brought to our current state of finances. I stopped reading the Money Make-Over by Dave Ramsey a few years ago after the chapter of the first baby-step: Save $1,000. At that point, this baby step felt completely out of our reach. While our ultimate goal has been financial peace, it is taking a long time to get there. We are doing it far from perfectly but I’m okay with that.

Mr. Sexy and I are going through Ramsey’s book again. We have reached Baby Steps one and two – thanks to Mr. Sexy. Whenever I have felt hopeless about our black hole of debt, he reminds me how much we are paying off every month AND we are paying bills on time AND we have more than we need for groceries AND we are able to save for fun family activities.

It was hard to start saying NO to what I wanted. It was hard to decline events with friends because we didn’t have any money. It was hard to ask for help or accept help when it was offered.

It was hard to start saying NO to what I wanted. It was hard to decline events with friends because we didn’t have any money. It was hard to ask for help or accept help when it was offered.

Bottom line, the road towards financial peace has been hard. But with every seemingly small decision, we are one tiny baby step closer to financial freedom. Mr. Sexy and I have come so far from when we took out a title loan on our family vehicle in order to pay for our honey moon. I think that was the stupidest financial decision we made.

A few years ago Mr. Sexy and I made the choice to gain control of our finances and our lives. It has felt beyond hopeless at times. But every day we are continuing the journey and making strides towards financial freedom.

It feels so good to get control, doesn’t it. My husband managed all of our finaces until his stroke. And I am the first to admit that he was terrible at it. He also gave me whatever I wanted and I never asked how he was paying all the bills and affording all the extra. I call that keeping my head in the sand. After I took over we flourished. I am such a tight a**. And I love it!!

Smidgen Snippets & Bits

LikeLike

Great job on taking back your finances! It sounds like you are on a great start to your financial freedom.

LikeLike

I so feel ya!! we weren’t making bad decisions necessarily, it was just adjusting to one income. I had to give up …well, everything that wasn’t food, kids clothing, or house and car related. no more lattes. no more hair stylist. no more pedicures – or any type of spa. no lunches with friends. no movies with friends. date night? ppffftt. in home maybe. It’s just plain hard to give up so much, that so many take for granted and just buy. we also managed to save, and just now are enjoying the fruits of that labour. and then we will have to start over again. Or, I have to get a job that allows me to be here morning and night for the kids: because I am not working only to pay child care.

Maybe we will get this book to and see if it can help us even more.

LikeLike

Great book. Hard to act on those baby steps. But keep trying together. My husband and I are working thru our debt snowball.

LikeLike

I love your testimony!

LikeLike